How successful cities are luring real estate investment

As investors continue to look for safe-haven destinations when allocating assets

And, some of the world’s most established cities are benefitting, as “investors are increasingly focusing on whether a city is future-proofed in order to retain the long-term value of their assets,” according to JLL’s Director for Global Research, Jeremy Kelly.

The make and break

Established World Cities have common traits, including: strong corporate presence; a market size that supports diverse opportunities for companies and people; sophisticated knowledge and innovation platforms; attractive global brand and identity; as well as gateway functions for investment, trade and tourism.

JLL’s recent Decoding City Performance report, currently classes seven Established World Cities – London, New York, Paris, Tokyo, Singapore, Hong Kong and Seoul, a new entrant this year. Among them, London, New York, Paris and Tokyo are also top real estate investment destinations, all featuring in the top 30 for Investment Intensity – a measure that compares the volume of direct commercial real estate investment in a city over a three-year period relative to the city’s current economic size. Investor appetite remains robust for assets in the world’s most globalised metropolitan economies, according to Kelly.

Besides the four, other cities with the highest real estate investment between 2014 and 2017 are Los Angeles, Shanghai and Boston.Hong Kong, Singapore and Seoul sit just outside the top seven real estate investment destinations.“Hong Kong and Singapore were regularly among the top seven investment markets over the 2008-2012 period, but have fallen out more recently due to either cooling measures or weak market fundamentals,” explains Kelly. “By contrast, Los Angeles is having a good run in terms of investment, while Shanghai is benefitting from high levels of domestic liquidity.”

Another key concern for investors, according to JLL, is the issue of transparency.“Of the ‘Big Seven’, Seoul has relatively low levels of transparency, which is hindering its prospects for moving into the top seven for real estate investment,” he says.

With Seoul only 35 miles from the Demilitarized Zone with North Korea, it is also most impacted by ongoing tensions. While Los Angeles, Shanghai and Boston are among the world’s top real estate investment destinations, they lack some of the global gateway functions and infrastructure platforms required to make the step up to the top group. Out of these three cities, however, Los Angeles and Shanghai are closest to joining the Big Seven, due to their scale, appeal, soft power and global specialisation. Prospects in Los Angeles are enhanced further by a renewed focus on infrastructure improvements and the impetus provided by hosting the Summer Olympics in 2028.

According to Kelly, the ten imperatives for a successful city laid out in JLL’s report Decoding City Performance are highly relevant to investors who are seeking the next wave of winning cities, and include:

- Fostering Innovation Pathways – Cities with distinct innovation pathways such as tech startups and centres for corporate R&D create real estate investment opportunities.

- Uncovering Hidden Talent – Location decision-making by companies is driven by the availability of a diverse talent pool, which includes not just tertiary graduates but a mix of vocational and specialist skills.

- Investing in Infrastructure – A city’s infrastructure platform is increasingly regarded as a critical determinant of how well cities can participate in the global economy.

- Thinking long-term – Real estate investors and businesses are beginning to take into consideration cities which address environmental sustainability and resilience to future-proof their assets.

- Good city governance – Real estate markets are impacted by long-term visions, coordinated planning and the ability of cities to act as stable partners. Evaluating the nuances of how cities are run will be crucial to identifying the next set of successful cities and real estate markets.

- Transparency – There is widening recognition among governments and urban planners of the crucial role that a transparent real estate sector plays in city competitiveness, not only as a facilitator of new investment and business activity, but also in community well-being and inclusiveness.

- Being Smart – City governments that are well-resourced establish coherent cross-cutting strategies and offer opportunities for smart building development.

- Affordability – Companies are constantly on the lookout to move their operations to cheaper locations to boost efficiencies and reduce costs.

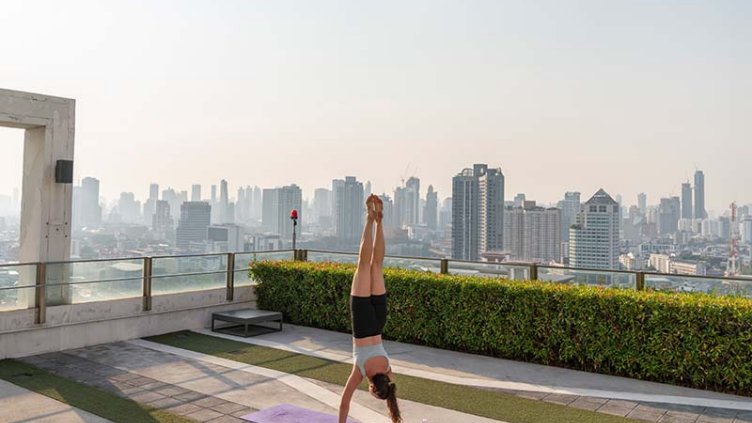

- Building Brand – Reputation is key in attracting businesses, talent and visitors; and cities are using innovative real estate and impressive skylines to project their brands and identities.

- Going Global – Globalised cities attract more attention from international investors and businesses.